Tier 6 pension calculator

On account of Covid-19 outbreak we are operating with considerably reduced employee strength. State Pension age is gradually increasing for men and women and will reach 67 by 2028.

Net Worth Calculator Find Your Net Worth Nerdwallet

Tier 1 members in Teachers Retirement System of the State of Illinois first contributed to TRS before Jan.

. Tier I account is mandatory for investors to join NPS whereas Tier II account is optional. Both Tier I and Tier II accounts require a minimum contribution of Rs 1000 at the time of opening the account. Get all the latest details of SBI Pension Fund - Scheme E - TIER I National Pension Scheme NAV 387677 Performance NPS Investment Growth Chart Ratings more at The Economic Times.

Four-tier coronavirus alert levels. HDFC Pension Fund - Scheme G - TIER I is an NPS scheme that invests predominantly in GOI Securities. This scheme is meant for TIER I investorsUnder NPS investors get 2 accounts namely Tier I account and Tier II account.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. State Pension age is going to be kept under review which means that it could change again in the future depending on different factors such as changes in life expectancy. What you can do with your pension pot.

Calculate the amount of pension wealth you will accumulate on retirement. Tier 1 railroad retirement benefits are the part of benefits that a railroad employee or beneficiary would have been entitled to receive under the social security system. More than 79 lakhs subscribers joins Atal Pension Yojana APY during the Financial year 2020-21.

HDFC Pension Fund - Scheme E - TIER I is an NPS scheme that invests predominantly in EquityThis scheme is meant for TIER I investorsUnder NPS investors get 2 accounts namely Tier I account and Tier II account. NPS Tier 2 is eligible for tax deduction under Section 80C for government employees. Expected Annuity Rate- Enter the expected annuity rate ie.

Coronavirus Christmas rules explained. Tier 1 benefits as well as benefits similar to those under a private pension Tier 2 benefits. As per PFRDA Exits Withdrawals under NPS Regulations 2015 following Withdrawal categories are allowed.

Tier II minimum subsequent contribution. Membership - Tier 1 Tier 1 and Tier 2 Tier 1 plan member. There is no clarity on how the gains in NPS Tier 2 will be taxed for such employees.

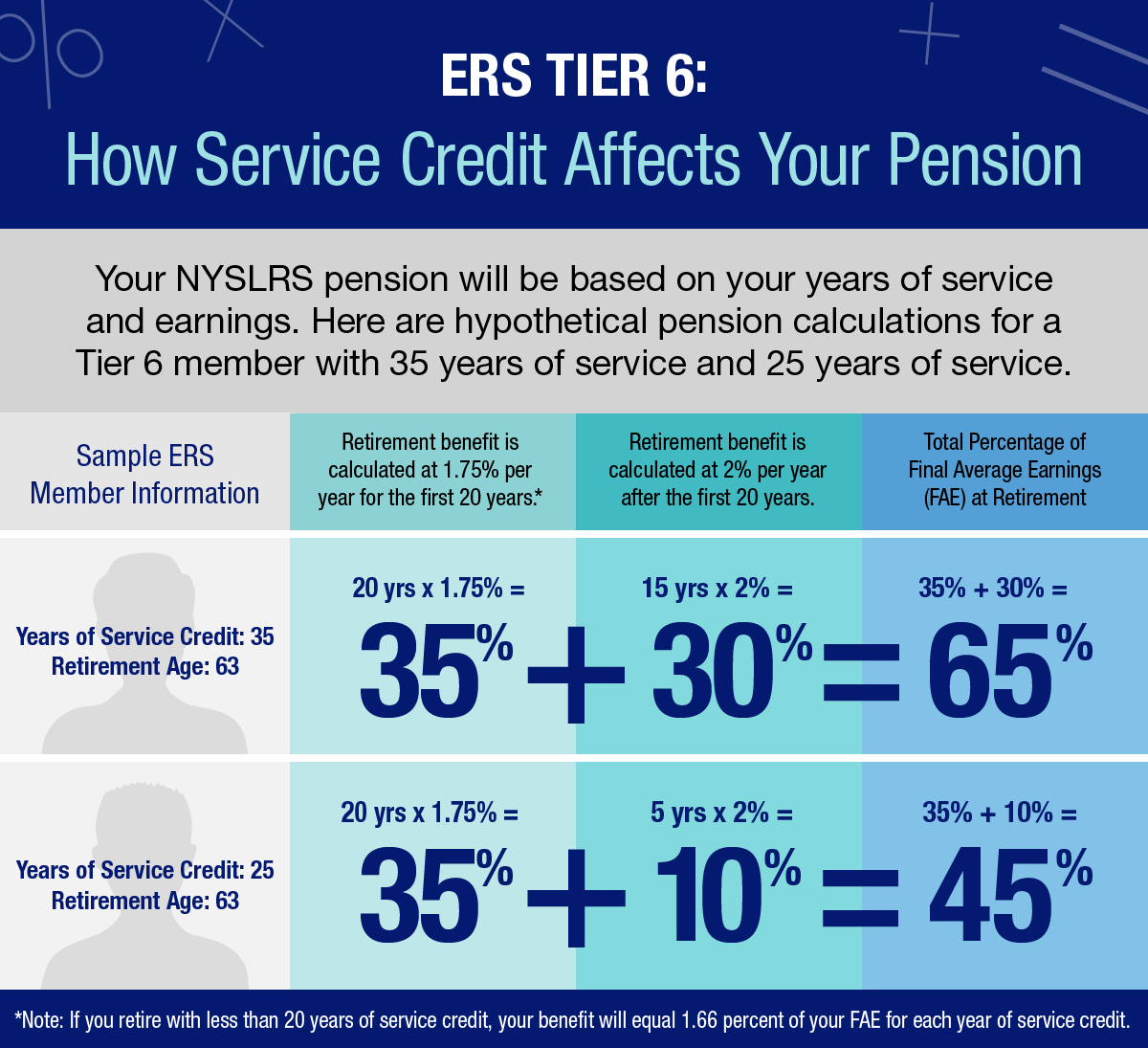

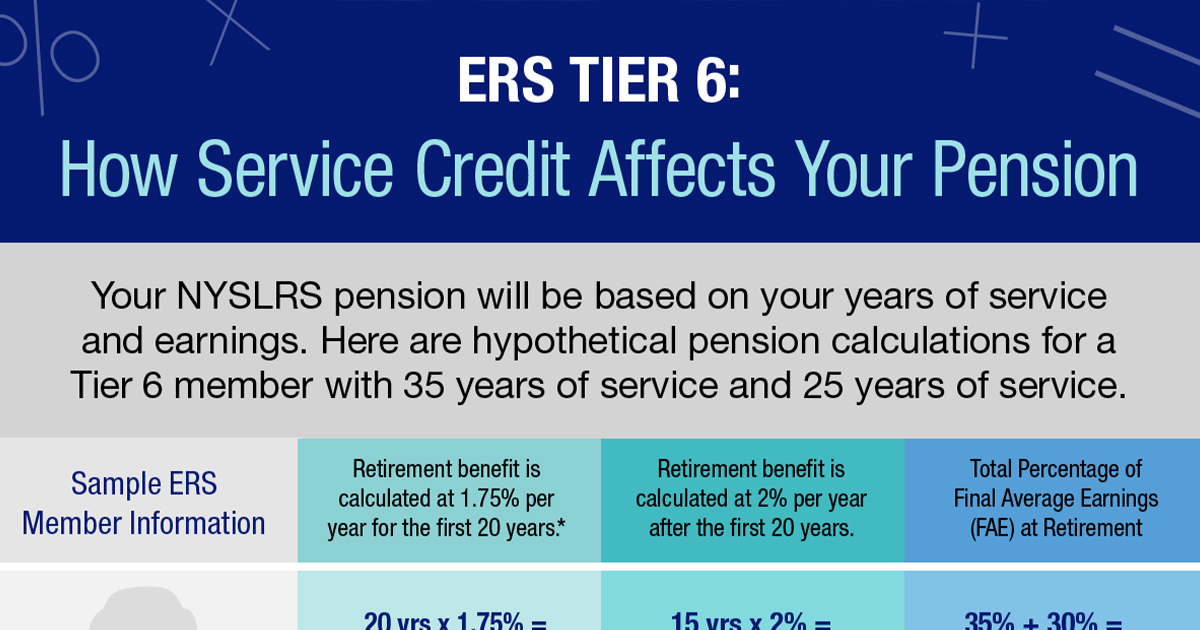

For ERS Tier 6 members in regular plans Article 15 the benefit is 166 percent of your FAE for each full year you work up to 20 years. Your pension factor equals either. 1 2011 or have pre-existing creditable service with a reciprocal pension system prior to Jan.

After 20 years the benefit grows. By January 31 of each year we mail 1099-R forms to retirees with taxable pensions. 16 million older people are going without the care they need and 2 million carers are older themselves.

A 167 per year if you have less than 20 years of service or b 175 per year for all service if credited. But this isnt even enough to cover the essentials so youll need to supplement this with a private pension either through your workplace or a personal pension through an insurance or. To estimate how much will be withheld from your pension each month you can use our federal tax withholding calculator.

For instance lets take a 30-year-old investor making a monthly contribution of Rs. Use Money Helpers pension calculator to help you work out how much money youll need in retirement and how much youll need to save. Any member of the Retirement System who first began eligible.

For help understanding your 1099-R. Total enrollments under APY has crossed the landmark of 3 crores. The minimum subsequent contributions mentioned above should be made regularly to avoid any future inconvenience.

Pensions scams and fraud. Interestingly the NPS calculator on the official NPS Trust website shows that a Rs 5000month contribution to the NPS Tier-1 account from the age of 25 could result in a monthly pension of over. Tax on NPS Tier 2.

The calculator will also ask you to input your expected rate of NPS return. Tier 1 2 3 and 4 rules explained. IPU 15U1609 issued 11-4-2015 Reissued IPU 17OU849 6-15-2017 IRM 201431 Exception.

They dont include supplemental security income SSI payments or benefits you received on behalf of a dependent. Four-tier coronavirus alert levels. Upon Normal Superannuation At least 40 of the accumulated pension wealth of the Subscriber has to be utilized for purchase of an Annuity providing for monthly pension to the Subscriber and the balance is paid as lump sum to the Subscriber.

Tier I account is mandatory for investors to join NPS whereas Tier II account is optional. Assuming an average NPS rate of. Tier I minimum subsequent contribution.

Depends on the asset allocation and pension funds chosen by you. Form CT-1 is processed at Cincinnati Submission Processing Campus. The Tier 2 account would also have a lock-in of 3 years.

Any member of the Retirement Systems who had service for which he or she received credit in the Employees Retirement System or in the Teachers Retirement System prior to January 1 2013. Get Complete Details of ICICI PRUDENTIAL PENSION FUND SCHEME E - TIER I National Pension Scheme and Know the detail information about its Benefits features How it works NPS Investment Growth. Once you enter all the details the National Pension Scheme calculator will simultaneously calculate the estimated lump-sum amount and pension amount you will receive at the time of maturity.

Private School Service Credit If you previously worked in a recognized private school you may be eligible to purchase up to 2 years of service credit. Penalty adjustments on Form CT1 should be made only after contacting the Cincinnati. Most people qualify for at least some state pension which is 18515 a week in the 2022-23 tax year for the full level of the new single-tier state pension.

Full increase of 2400 x 12 1200. Use the form below to estimate the pension you could collect after a career as a general employee of state or local. SBI Pension Fund - Scheme E - TIER I.

ICICI Prudential Pension Fund - Scheme E - TIER I is an NPS scheme that invests predominantly in EquityThis scheme is meant for TIER I investorsUnder NPS investors get 2 accounts namely Tier I account and Tier II account. However the pension was in effect for only 6 months in the first year of retirement July through December so the first annual increase is applied to only 6 months of pension payments. NPS and NPS returns including those from NPS Tier 2 account come under the Pension Fund Regulatory and Development Authority PFRDA.

1200 an increase of 200 per month for the first six months of retirement. Tier 2-6 members in active service may retire at age 55 with five years of New York State service credit. Vested Tier 6 members with an inactive membership must be at least 63 to retire.

6 months 12 of 12 months. Tier 2 plan member. Tier I account is mandatory for investors to join NPS whereas Tier II account is optional.

Tier 1 2 3 and 4 rules explained. The amount of annuity that you want to receive from your pension. Depending on the contract other events such as terminal illness or critical illness can.

At 20 years the benefit equals 175 percent per year for a total of 35 percent.

Ny Teacher Pension Calculations Made Simple The Legend Group

Your Retirement Estimate And Payment Options Youtube

Have You Checked Your Benefit Factor Chart Calpers Perspective

How Do You Calculate A Teacher Pension Teacherpensions Org

Estimate Your Benefits Arizona State Retirement System

How Much Will I Get

Post Retirement Income Archives New York Retirement News

Calculators Ipers

Pension Calculator Contra Costa County Employees Retirement Association

Sdcers Benefit Estimate Calculator

Ers Tier 6 Benefits A Closer Look New York Retirement News

The Gov S Pension Empire Center For Public Policy

Ny Teacher Pension Calculations Made Simple The Legend Group

How To Create A Retirement Estimate Los Angeles Fire And Police Pensions

Estimate Your Benefits Arizona State Retirement System

Calculate Bonus In Excel Using If Function Youtube

.png)

Sdcers Benefit Estimate Calculator